japan corporate tax rate history

However it was abolished. A tax of 8 is paid on most of the purchases made by the company and this consumption tax paid on purchases can be claimed to the tax office.

Corporate Tax Reform In The Wake Of The Pandemic Itep

Income Tax Controversial tax law.

. Initially until April 2017 and then October 2019. KPMGs corporate tax table provides a view of corporate tax rates around the world. 27000 yen 81 21870 yen.

There was a tax named 地方法人特別税. Structure of Multi-stage Taxation of Consumption Tax. Local corporation tax applies at 44 on the corporation tax payable.

The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a share capital which exceeds JPY 100 million USD 896387. An update to this dataset has been posted to the Tax Foundation Github data archive. Taxable Income Tax Rate less than 195 million yen 5 of taxable income 195 to 33 million yen 10 of taxable income minus 97500 yen 33 to 695 million yen 20 of taxable income minus 427500 yen 695 to 9 million yen 23 of taxable income minus 636000 yen 9 to 18 million yen.

The new bill increased the tax to 8 in April 2014 and 10 in October 2015. This tax calculator is used to assess what amount is the crossover point where its more beneficial to classify income from investment property as personal or corporate in order to. 6 rows Date Range.

So 1 million yen 35 35000 yen ⑤. 150000 yen 173 70000 yen 95950 yen. Our company registration advisors in Japan can deliver more details related to the corporate tax in this country.

Since then the rate peaked at 528 in 1969. Tax rates for companies with stated capital of more than JPY 100 million are as follows. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019.

Tax Rate applicable to fiscal years beginning between 1 April 2016 and 31 March 2018. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

Local management is not required. US Federal Corporate Income Taxes. The current rate has been raised from 5 to 8 on April 1st 2014.

法人事業税 Corporate business tax is 35 of taxable income. Japanese income tax can be sometimes confusing and difficult to understand. So about 30 of pretax profit will be paid to tax.

Dec 2014 Japan Corporate tax rate. 5 rows 73 51 73 53 Over JPY 8 million. This page displays a table with actual values consensus figures forecasts statistics and historical data charts for - List of Countries by Corporate Tax Rate.

So 35000 yen 37 12950 yen ⑥. National Income Tax Rates. Business tax Jigyo zei.

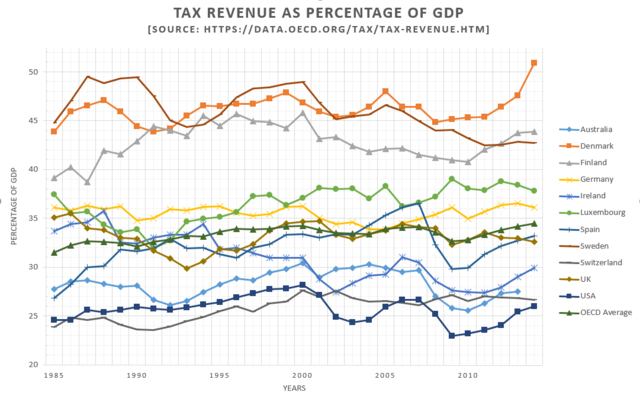

Chapter 3 - Table 32 Total tax revenue in US dollars at market exchange rate Chapter 3 - Tables 37 to 314 - Taxes as of GDP and as of Total tax revenue Chapter 3 - Table 315 - Tax revenues of subsectors of general government as of total tax revenue. Measures the amount of taxes that Japanese businesses must pay as a share of corporate profits. In Japan the Corporate Income tax rate refers to the highest corporate tax rate for companies with taxable income above 8 million JPY a year based in Tokyo.

Japan Corporate tax. Prior to 2009 Japans international tax system bore a remarkable resemblance to that of the United States It taxed on a worldwide basis provided foreign tax credits allowed deferral of tax on active income until repatriation and claimed the highest corporate tax rate in the developed world. OECD Corporate Income Tax Rates Australia Austria Belgium Canada Chile Czech Republic Denmark Estonia Finland France Germany Greece Hungary Iceland Ireland Israel Italy Japan Korea Luxembourg Mexico Netherlands New Zealand Norway Poland Portugal Slovak.

In introducing the 2009 budget however the Japanese Minister of. The tax rate information on this page was last updated in January 2021 and the below historical tax rate data is available for. 特別法人事業税 Special corporate business tax is 37 of amount of 法人事業税 Corporate business tax.

Outline of the Reduced Tax Rate System for Consumption Tax. Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident. Items Covered by the Reduced Tax Rate System.

KPMGs corporate tax table provides a view of corporate tax rates around the world. The consumption tax is similar to European VAT. The current effective corporate tax in around 40 with lower tax rates for small companies.

Information on Japanese tax system can also be obtained from the following URL. Corporation tax is payable at 234. 1 If a company has capital in excess of 100 million Japanese yen or is a wholly owned subsidiary of a large corporation with capital of more than 500 million Japanese yen the company is treated as large corporation under corporate tax.

List of Countries by Corporate Tax Rate - provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data. However due to Japans economic situation the Abe government delayed the tax increase to 10 twice. 1 million yen 27 27000 yen.

Corporate resident tax Hojin Juminzei. 96 67 96 70 Local corporate special tax. Special local corporation tax chiho hojin tokubetsu zei.

1 2018 the corporate tax rate was changed from a tiered structure that staggered corporate tax rates based on company income to a flat rate of 21 for all companies.

Global Minimum Corporate Tax Rate Wikipedia

How Do Taxes Affect Income Inequality Tax Policy Center

Real Estate Related Taxes And Fees In Japan

What Would The Tax Rate Be Under A Vat Tax Policy Center

Taxation In Australia Wikipedia

Lithuania Corporate Tax Rate 2021 Data 2022 Forecast 2006 2020 Historical

Taxation In Australia Wikipedia

/dotdash_final_The_Impact_of_Exchange_Rates_on_Japans_Economy_Jan_2021-01-f43b9e40b4af4c97827fa21bda183e1c.jpg)

The Impact Of Exchange Rates On Japan S Economy

Taxation In Australia Wikipedia

11 Charts On Taxing The Wealthy And Corporations Institute For Policy Studies

Corporate Tax Reform In The Wake Of The Pandemic Itep

Real Estate Related Taxes And Fees In Japan

Corporate Tax Definition And Meaning Market Business News

The History Of Taxes Here S How High Today S Rates Really Are

How Do Taxes Affect Income Inequality Tax Policy Center

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

11 Charts On Taxing The Wealthy And Corporations Institute For Policy Studies